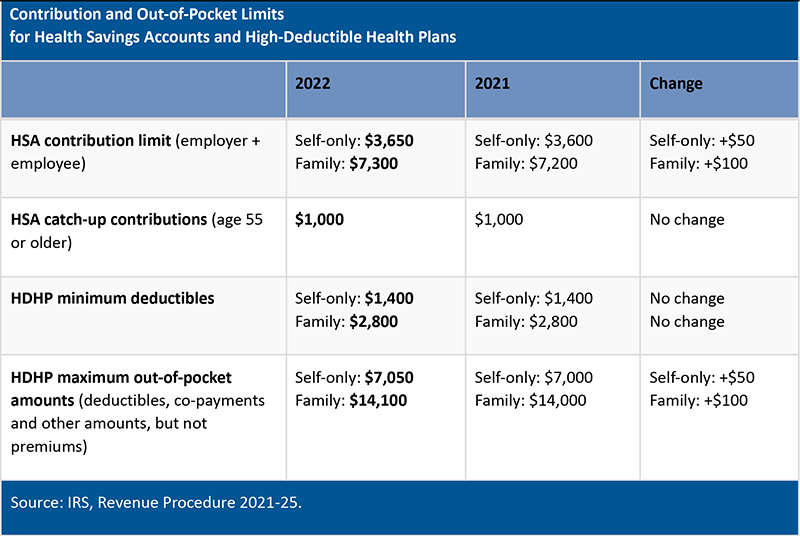

Health savings account (HSA) contribution limits for 2022 are going up $50 for self-only coverage and $100 for family coverage.

The annual limit on HSA contributions will be $3,650 for self-only and $7,300 for family coverage. That’s about a 1.4 percent increase from this year.

In Revenue Procedure 2021-25, the IRS confirmed HSA contribution limits effective for calendar year 2022, along with minimum deductible and maximum out-of-pocket expenses for the HDHPs with which HSAs are paired.

ACA’s Limits Differ

There are two sets of limits on out-of-pocket expenses for health plans, determined annually by federal agencies, which can be a source of confusion for plan administrators.

The Department of Health and Human Services (HHS) establishes annual out-of-pocket or cost-sharing limits under the ACA for essential health benefits covered under an ACA-compliant plan, excluding grandfathered plans.

On April 30, HHS released the Notice of Benefit and Payment Parameters final rule for 2022, published in the May 5 Federal Register. According to an HHS press release, the annual payment notice makes regulatory changes in the individual and small-group health insurance markets, and outlines parameters and requirements issuers need to design plans and set rates for the upcoming plan year.

The HHS’s annual out-of-pocket limits are higher than those set by the IRS, but to qualify as an HSA-compatible HDHP, a plan must not exceed the IRS’s lower out-of-pocket maximums.

Below is a comparison of the two sets of limits: